Members of Freshfields’ Securities and Shareholder Litigation team today released an analysis of federal securities fraud claims filed in 2025 against issuers headquartered outside the United States. Although filings against ex-U.S. issuers continued to decline last year, the landscape remains high-stakes and continues to evolve in important ways for global companies accessing U.S. markets.

Below is an overview of the key trends highlighted in the analysis, which is also available here.

Filings Down, but Risk Persists

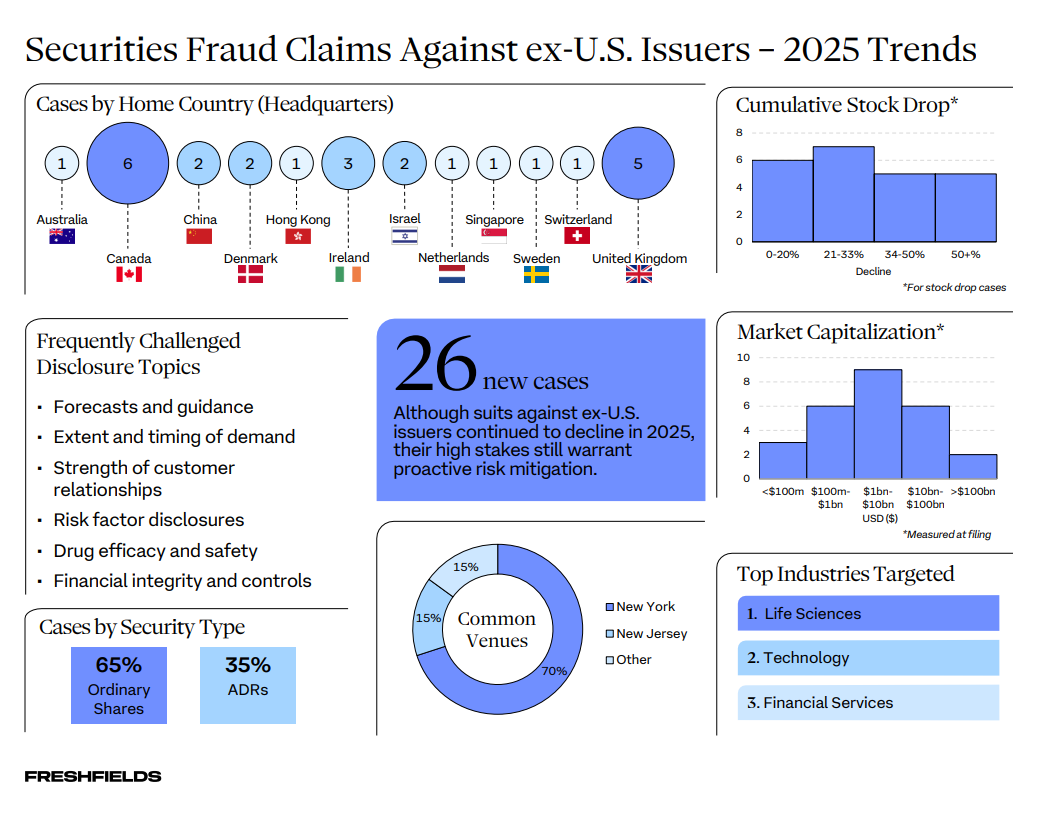

While new cases against ex-U.S. issuers fell to 26 in 2025, the high-stakes nature of these lawsuits continues to warrant proactive risk mitigation. Issuers also face shareholder litigation risk from other sources, such as derivative actions.

Geographic Diversity

Targets were geographically diverse. Canadian issuers were the most frequent targets (6 cases), followed by 5 in the U.K., 3 in Ireland, and 2 each in China, Denmark, and Israel.

Mid- and Large-Caps Still Primary Targets

Approximately two-thirds of the ex-U.S. issuers sued had market capitalizations of $1 billion or more, underscoring their heightened exposure risk.

Key Industries in Focus

Life sciences, technology, and financial services were the most targeted industries. Last year’s complaints focused on pharmaceutical trials, supply chains, efficacy of and demand for AI products or services, and cryptocurrency, among other topics.

ADRs Remain Significant Litigation Pathway

More than one‑third of cases involved American Depositary Receipts (ADRs), reiterating that U.S. securities litigation exposure can extend beyond issuance of ordinary shares.

Key Disclosure Themes

The most commonly challenged statements concerned forecasts, demand, risk factors, customer relationships, drug efficacy, and internal controls, emphasizing the breadth of disclosures that were challenged.