Companies conducting cross-border business often need to navigate a complex web of sanctions and trade-related restrictions. These considerations are especially relevant in high-risk jurisdictions—regions marked by conflict or geopolitical tension, and which typically have an elevated number of individuals, entities, and activities that can expose companies to sanctions risks.

Sanctions are an increasingly favored and complex foreign policy tool that include a wide array of restrictions: territorial limitations, entity designations, asset freezes, financial sanctions, capital and financial restrictions, export controls, tariffs, service bans, investment bans, sectoral measures, and price caps. To make matters more complex, the application and interpretation of global sanctions can diverge from regulator to regulator, which can lead to commercial complications for businesses operating in high-risk jurisdictions. Now more than ever, companies investing and operating in high-risk jurisdictions should consider sanctions and trade restrictions at all stages of the business lifecycle, from the decision to enter a market through ongoing operations through a potential future exit.

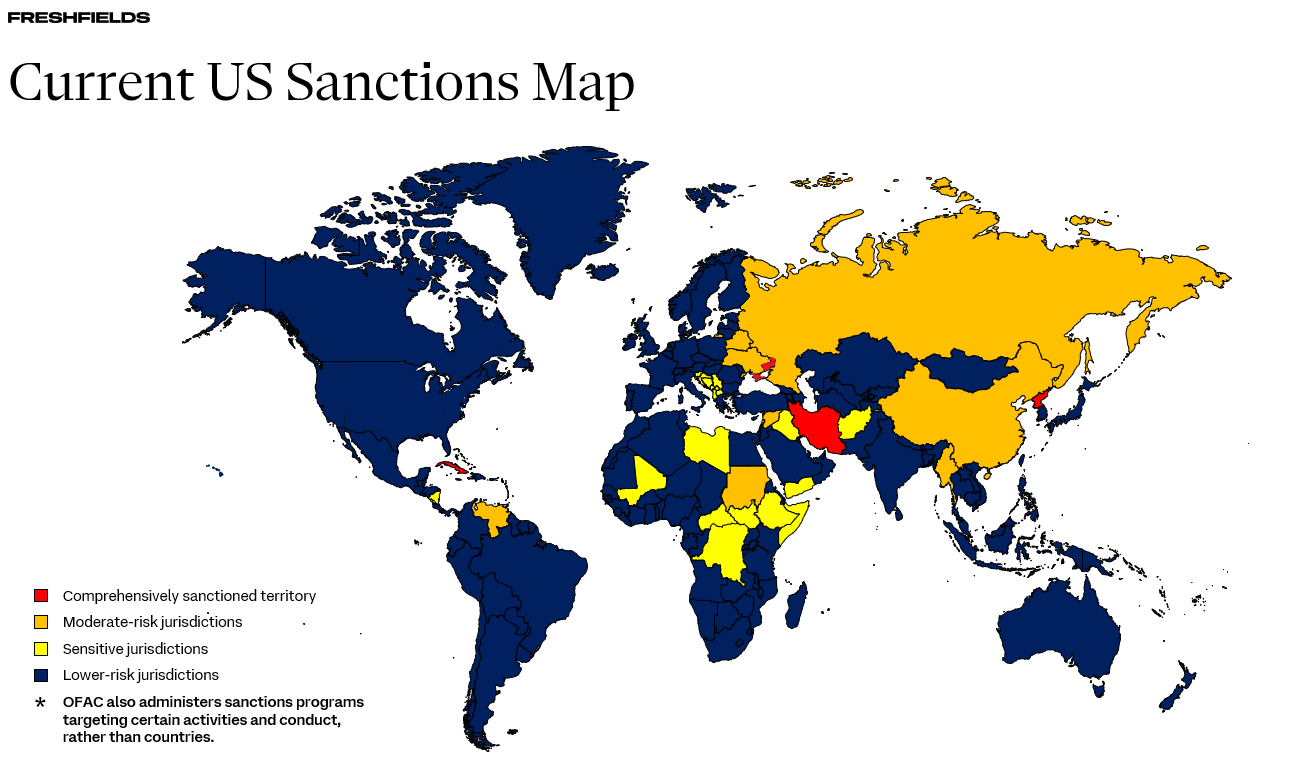

What are the High-Risk Jurisdictions?

US primary sanctions, which are predominantly administered by the U.S. Treasury Department’s Office of Foreign Assets Control (OFAC), generally prohibit US persons (typically defined to include persons located in the United States, US nationals and permanent residents, and companies incorporated in the United States, including their foreign branches) and non-US persons where there is a US nexus (e.g., a US dollar transaction cleared through the US financial system) from engaging in or facilitating dealings involving certain territories, persons, and/or conduct.

Additionally, non-US persons may also face US sanctions risk even without a US nexus under US secondary sanctions. Accordingly, US and non-US persons alike might consider their exposure to US sanctions risk, especially when engaging in dealings in jurisdictions that present a higher-risk from the perspective of US sanctions.

- Comprehensively sanctioned territories. Of OFAC’s sanctions programs, the highest-risk jurisdictions are those targeted by comprehensive sanctions (currently, Cuba, Iran, North Korea, and the Crimea and so-called Donetsk People’s Republic and Luhansk People’s Republic regions of Ukraine), which generally prohibit all US person dealings.

- Moderate-risk jurisdictions. These jurisdictions include Russia, Belarus, Myanmar, China, Sudan, Syria, Ukraine and Venezuela. While not comprehensively sanctioned, these moderate-risk jurisdictions were either recently targeted by comprehensive sanctions (e.g., Syria and Sudan), broadly restrict certain types of activities (e.g., new investment in Russia), or have their governments targeted by sanctions (e.g., Venezuela).

- Sensitive jurisdictions. OFAC has a sanctions program for these jurisdictions containing certain criteria to designate persons, but these jurisdictions do not have as broad of restrictions as target the comprehensively sanctioned territories or moderate-risk jurisdictions.

- Lower-risk jurisdictions. OFAC does not currently have a sanctions program containing designation criteria for these jurisdictions, but they still may have persons designated under sanctions programs targeting other countries.

- Non-jurisdiction-specific risks. Note that OFAC also administers certain non-jurisdiction-specific sanctions programs targeting certain activities and conduct (e.g., Counter Terrorism Sanctions; Cyber-Related Sanctions).

In addition to US sanctions, US export controls impose restrictions on the export, reexport, and transfer (in-country) of items subject to US export controls under the Export Administration Regulations (EAR) to certain jurisdictions, end-users, and end-uses. Items subject to the EAR generally include items that are (i) located in the United States, (ii) of US origin, (iii) a foreign-made commodity that contains more than a de minimis amount of US-origin controlled content by value, or (iv) a foreign-produced item that is a direct product of specified controlled technology or software that is subject to the EAR. US export controls are typically more relevant in the context of dealings involving high-risk jurisdictions, which are generally targeted by more stringent export controls than low-risk jurisdictions and in some cases are targeted by comprehensive embargoes or embargoes that restrict trade in selected categories of items.

Additional Jurisdictions

Other major jurisdictions, such as the UK and EU, also impose sanctions and export control restrictions that may be relevant in high-risk jurisdictions. The UK and the EU typically impose similar restrictions as the United States, however, the UK and EU’s sanctions and export control restrictions typically (with some notable exceptions) include a subset of the targets and restrictions that are imposed under US sanctions and export controls.

Companies operating in high-risk jurisdictions might consider assessing which jurisdictions’ sanctions and export controls apply to their dealings to help mitigate the risk of inadvertently breaching such restrictions.

Navigating Global Sanctions and Export Controls when Operating in High-Risk Jurisdictions

Companies seeking to navigate sanctions might consider adopting a proactive approach to compliance, including conducting heightened due diligence and implementing contractual protections.

- Heightened due diligence: Companies operating in high-risk jurisdictions might consider conducting heightened due diligence on counterparties and third-party intermediaries. This due diligence could include analyzing (i) ownership and control of counterparties and third party intermediaries, as US sanctions prohibitions generally apply to persons owned 50% or more by or acting on behalf of designated parties and/or a counterparty could be a restricted end-user under export controls; and (ii) whether items to be exported are targeted under export control restrictions. Accordingly, businesses might consider undertaking due diligence into the ownership structures of counterparties to help prevent inadvertently dealing with a restricted party.

- Contractual protections: Companies operating in high-risk jurisdictions might consider including appropriate sanctions and export control-related compliance representations, warranties, and undertakings in agreements. For instance, a clause might require a counterparty to certify that it is not a sanctioned person and that it will not use any goods, services, or funds from the transaction to benefit a person targeted by sanctions. Well-drafted clauses may help provide an exit ramp and other protections if a counterparty becomes sanctioned or if performance of the contract becomes prohibited under applicable sanctions or export controls (e.g., an agreement might also include robust termination and exit rights, in case of a sanctions event).

Even when companies decide to divest or exit from a high-risk jurisdiction, sanctions and export control risks persist. For example, businesses operating in a territory targeted by sanctions may face operational difficulties and costs resulting in fewer interested buyers and a potential sale of the business may be subject to regulatory approval. Sanctions may make a clean exit from a high-risk jurisdiction challenging.

Conclusion

Conducting business in high-risk jurisdictions often requires companies to exercise greater caution in transactions and other business arrangements to help mitigate the risk of inadvertently breaching applicable sanctions and export controls. The consequences for violating the rules can be significant—potentially including substantial fines, lengthy investigations, and reputational consequences. Additionally, a company’s exposure to these risks can be long-lasting: US sanctions have a ten-year statute of limitations.

* * *

This blog post is part of an ongoing series exploring the legal, commercial, and strategic complexities of operating in conflict zones and high-risk jurisdictions. Contributors to this series include Freshfields attorneys Timothy Harkness, Kate Cooper, Joshua Kelly, Sylvia Noury, Alexandra van der Meulen, Carsten Wendler, Piusha Bose, Maria Slobodchikova, Paige von Meheren, Heather Cameron, Elischke de Villiers, Jackson Meyers and Jordan McGuffee. Stay tuned for upcoming posts, and please reach out with topics, questions, or experiences you’d like us to cover as part of this ongoing conversation.

For a collection of related previous posts and webinars, please click this link.