The Committee on Foreign Investment in the United States (“CFIUS”) recently released its calendar year 2024 annual report to Congress (“2024 Report”) including statistics on CFIUS operations. In this post, we offer unique insight into the data by adjusting it to eliminate double counting and other factors that may otherwise provide a distorted view.[i]

While most statistics in 2024 remained broadly consistent with prior years, the data reveals some trends that can help parties best plan for an efficient review. While this data reflects the last year of the Biden administration—providing limited insight into how CFIUS is operating under the Trump administration—we break down what the data shows and what we expect looking ahead to the current Trump administration.

Key takeaways from the 2024 Report:

- Declarations, with their often more favorable timelines, continued to be a good option for low-risk transactions for investors from countries that are partners or allies with the United States.

- The rate of mitigation decreased significantly compared to 2023 and was more in line with longstanding historical rates. Going to investigation did not necessarily mean that a transaction was headed to mitigation.

- CFIUS continued to struggle to negotiate mitigation within its statutory deadlines leading to extended timelines. If CFIUS identified a concern, there was a high likelihood that the notice would need to be withdrawn and refiled. As explained below, we anticipate that this trend may not continue to the same degree in the Trump Administration, though this remains to be seen.

- Chinese investments were still more likely to be blocked than approved.

- A public tip could result in a Presidential block.

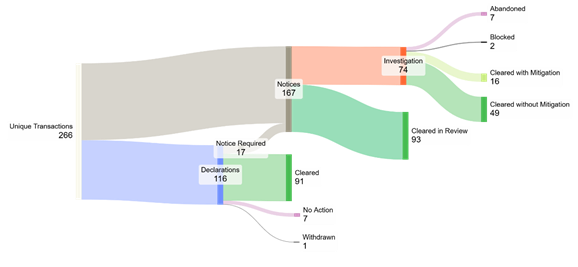

Figure 1: Adjusted Numbers

I. Fewer Transactions Filed, Better Outcomes with Declarations

- The total number of unique transactions filed with CFIUS declined slightly to 266 in 2024, continuing a downward trend from the peak of 343 unique transactions in 2021.

- Parties can elect to file a short-form declaration or long-form notice. Each has its benefits and drawbacks with it commonly understood that declarations are best suited for lower risk, less complex cases. If CFIUS needs more time, it can ask that a notice be filed after its review of a declaration.

- The 2024 Report shows the declarations process is being utilized more effectively both by filing parties and CFIUS.

- In the first couple years after the declarations process was introduced in 2020, parties met with relative success, as only about 20% of declarations lead to requests for notices. Then, in 2022, whether because parties overestimated what transactions could appropriately be filed as a declaration or because CFIUS took a more aggressive approach, the rate of requests for notices jumped to 32%.

- As a result, parties became much more cautious in 2023, with a nearly 8% drop in the rate of transactions being filed as declarations. The more discerning use of the declarations process, however, resulted in the rate of CFIUS requesting notices dropping back down to 18%.

- This improved performance resulted in growing confidence in the declaration process in 2024—particularly among investors from allied countries, as led by investors from Japan and Canada—yielding an increase in the rate of filing of declarations and a continued drop in the rate of CFIUS requesting notices:

| Percent of unique transactions filed as declarations | Percent of declarations ending in request for a notice |

2021 | 48% | 18% |

2022 | 48% | 32% |

2023 | 39% | 18% |

2024 | 44% | 15% |

- Looking ahead: The Trump administration’s focus on streamlining the process will likely continue to make declarations a viable option for low-risk transactions, in particular, transactions with allied countries.

II. Remedies: A Return to the Norm on Mitigation?

- In 2024, CFIUS identified concerns requiring a remedy in 25 transactions.

- CFIUS’s national security concerns resulted in 9 investments being abandoned or divested, including up to 7 where the parties abandoned the transaction after CFIUS likely informed them it intended to recommend a block to the President and 2 that were the subject of Presidential prohibition orders.[ii] Notably, while the overall rate of transactions failing due to CFIUS concerns has remained relatively constant since 2019, 2024 was the first year in which the President prohibited any transactions since 2020.

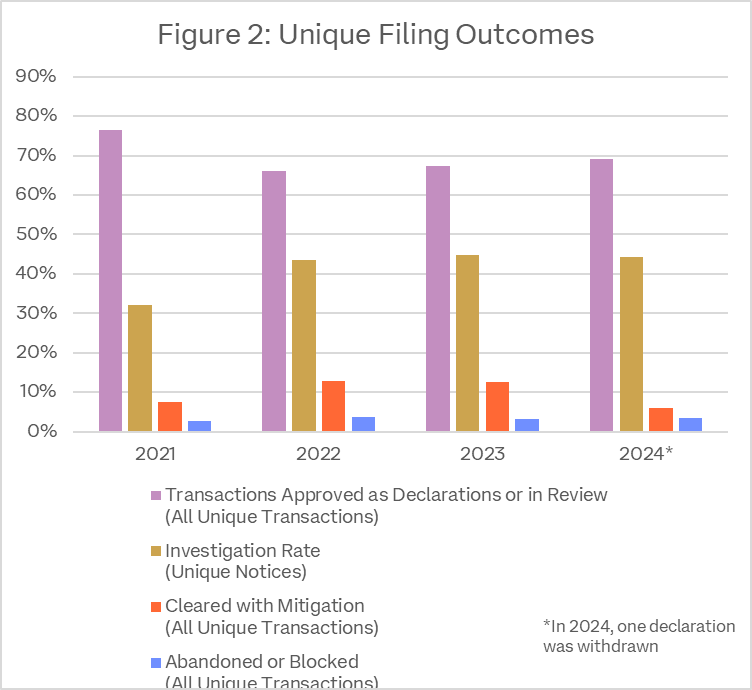

- CFIUS required mitigation in 16 transactions, or 10% of unique notices filed (6% of unique transactions). This is a significant decrease, down from 19% of unique notices filed (13% of unique transactions) in 2022 and 18% of unique notices filed (13% of unique transactions) in 2023.

- The overall rate of unique notices going to investigation (i.e., phase 2 review) did not drop materially (45% in 2023 and 44% in 2024). However, only 34% of unique transactions that went into investigation required remedies (i.e., cleared with mitigation, abandonment upon CFIUS determining it has concerns, or presidential block) in 2024, down from 52% in 2023. This means that going to investigation in 2024 was much less of an indicator that mitigation or prohibition was likely than the previous few years.

- The 7 abandonments most likely were Chinese investments. With that assumption, and based on the estimated number of unique Chinese transactions filed, we estimate that the vast majority of the 16 transactions requiring mitigation likely involved non-Chinese acquirers. In other words, it continues to be the case that CFIUS is unlikely to rely on mitigation to address national security risks arising from Chinese investment and approve the transaction.

- Based on the number of refiles (discussed further below), the data suggests CFIUS frequently could not finalize mitigation within the 90-day statutory period allowed for notices, prompting parties to refile to complete mitigation.

- Looking ahead: Our experience under the America First Investment Policy suggests a mitigation-averse posture. Parties from allied countries may now face a more deal-friendly and streamlined process than under the last administration, leading to potentially even fewer cases being mitigated.

III. Mitigation Timeline Continues to be Long

- Although not available in every case, including notably in connection with Chinese investment, when mitigation is an option, it can take significant time to achieve. When an agreement on mitigation has not been reached by the end of the statutory timeline, parties often elect to refile their transaction to allow more time to reach agreement as the other options are less favorable.

- While there were significant improvements in CFIUS’s case processing in 2024, refiled transactions remained fairly constant, representing approximately 25% of unique transactions filed as notices.

- We assume the 7 abandoned and 2 blocked transactions each required at least 1, or in some cases, 2 withdrawals and refilings. This would account for less than half of the total number of withdrawals and refilings, meaning that most refiled transactions were due to the failure to conclude negotiations on mitigation agreements.

- Refiles may be attributable both to transaction parties not being timely in responding to CFIUS mitigation proposals or CFIUS notifying parties of the need for mitigation late in the process with insufficient time to complete negotiations.

- While (as noted in the previous section) going to investigation was much less likely to be an indicator that mitigation would be required, for those transactions where CFIUS did identify a concern, there was a high likelihood that a withdraw/refile would be required.

IV. Shifting Country Focus

- The composition of countries accounting for the largest number of CFIUS filings continues to shift from year to year. The top notice filers in 2024 were France, Japan, and the UAE. France being at the top of the list of CFIUS notice filers is unusual, but likely driven by an uptick in investment from France, plus the nature of the types of companies that happened to be acquired in 2024.

- Japan is a perennial top filer of transactions to CFIUS, driven in part by Japan being one of the largest sources of FDI into the United States generally.

- The UAE appearing in the top three is not surprising, as the UAE has been increasingly seeking to pursue economic diversification and reduce dependence on hydrocarbon revenues. President Trump’s early moves to welcome investment from the UAE suggest this trend is likely to continue into 2025.

| Rank by number of unique transactions | 2022 | 2023 | 2024 |

| 1 | Singapore | Canada | France |

| 2 | United Kingdom | Japan | Japan |

| 3 | Canada, Japan | United Kingdom | UAE |

V. China: Fewer Transactions, Continued Sensitivity

- China-related filings remain a focal point, but the data suggests a continuing decline in unique Chinese transactions going through the CFIUS process, likely now in the single digits.

- Although Chinese investments were reported to be the subject of 26 notices, China does not rank among the top three notice filers when adjusted for double counting.

- When adjusted (assuming that investments from China were likely refiled at least once), we estimate that CFIUS reviewed between 8 and 12 discrete Chinese transactions.

- We expect that several of these were likely non-notified transactions (i.e., transactions that CFIUS called-in) that occurred before 2024 such as the acquisition of certain real property by MineOne Cloud Computing Investment I L.P. (“MineOne”) that was prohibited by President Biden. This means the number of reviewed transactions involving new investment from China are likely even lower than our estimated 8 to 12 transactions.

- This aligns with anecdotal evidence that CFIUS continues to scrutinize Chinese investments intensely, with multiple abandonments, few approvals, and declining attempts to put Chinese investor transactions before the Committee.

- With 7 abandonments reported (most, if not all, likely involved Chinese investors) and one of President Biden’s two prohibitions (MineOne’s acquisition of real property in Cheyenne, Wyoming) involving Chinese investors, the data suggest that likely fewer than 5 China-related transactions received approval. This could mean that more transactions involving investors from China were prohibited or abandoned for national security reasons than approved by CFIUS.

- Looking ahead: We can expect this trend to continue as the Trump administration maintains a hardline approach to Chinese investment, as illustrated by the administration’s recent divesture order targeting Chinese-owned Suirui Limited International’s acquisition of Jupiter Systems, LLC. China adjacency risk may also be used as a lens through which CFIUS reviews investments from partner and allied countries.

[i] Following is the methodology that we have adopted in this analysis to identify “unique” transactions: If a declaration resulted in a request for a notice, the declaration and notice are treated as a single unique transaction. If a notice was withdrawn and refiled, the initial notice and the refiled notice are treated as a single unique transaction. As a very small number of transactions may have been withdrawn and refiled more than once, the methodology does not eliminate all double counting.

[ii] The annual report states that most of the 7 abandoned transactions were abandoned due to CFIUS concerns. It does not provide information to confirm this number precisely.